Credit reports are supposed to show how much money a person owes on various debts and when or if the borrower is making payments on those debts.

Because bankruptcy makes many types of debts go away completely and forbids collections, at least temporarily, on others, it can be like a tidal wave on the credit report. Clients often ask me what their credit report will say after the case is discharged. This article answers the question “what should each entry or trade line on my credit report say?” It does not say what your credit score should be after filing.

Each debt that appears on credit reports has what is called a trade line. The trade line says when the account was opened, what the balance it is, what type of loan it is (mortgage, car loan, credit card, installment loan and many others), the payment history, and what the current status is.

WHAT SHOULD MY CREDIT REPORTS SAY AFTER BANKRUPTCY DISCHARGE?

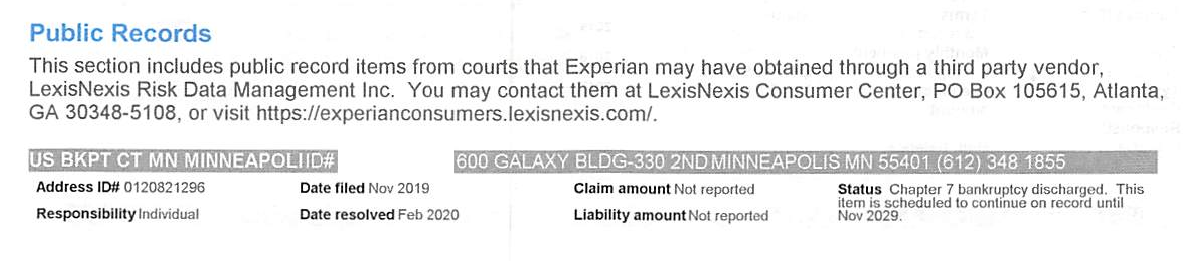

- The bankruptcy itself should show on the reports. It will be in the “public records” section and it should say who your attorney was and whether it was discharged or dismissed. Discharged means that it was successful and that you no longer owe the debts. Dismissed means that the bankruptcy did not finish and the debts have come back. Here is a sample below.

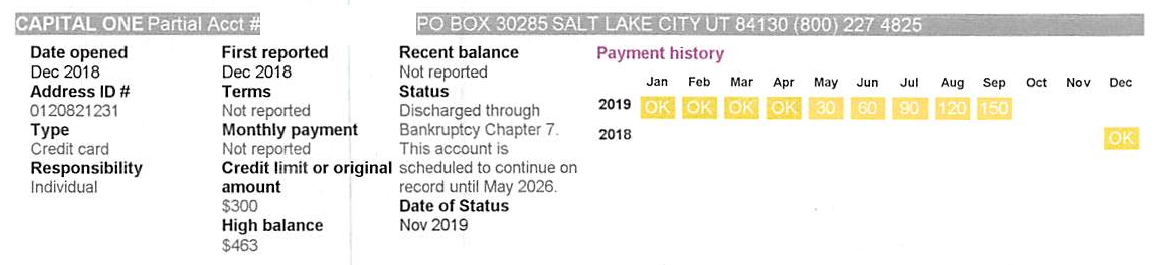

- The Trade Lines for credit cards and loans without collateral should have the payment history stop, and the balance should say $0, and the status should say “discharged in bankruptcy.” It will stay like this on the report for 6 years from the time it was discharged. Think of it as saying that this used to be a debt, but not anymore. The payment history should not have any new entries for nonpayment or late payment after the filing date. Here is an example from Capital One.

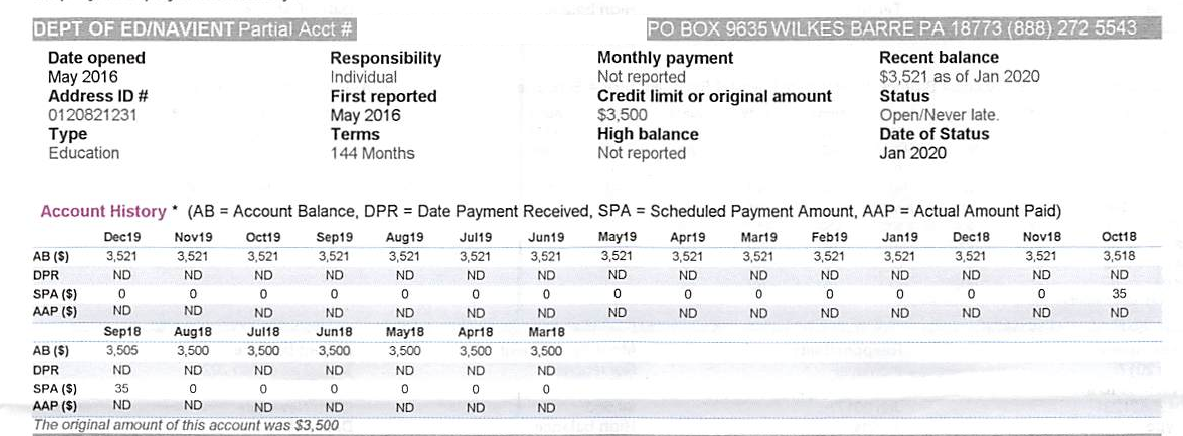

- What about Student loans? Student loans are rarely discharged in bankruptcy, so the credit reports should still show them as paid and current. If they weren’t getting paid, then they would still show late payments. Below is an example of student loans after bankruptcy. Here is an example from Navient. This student loan helped rebuild credit after the bankruptcy filing.

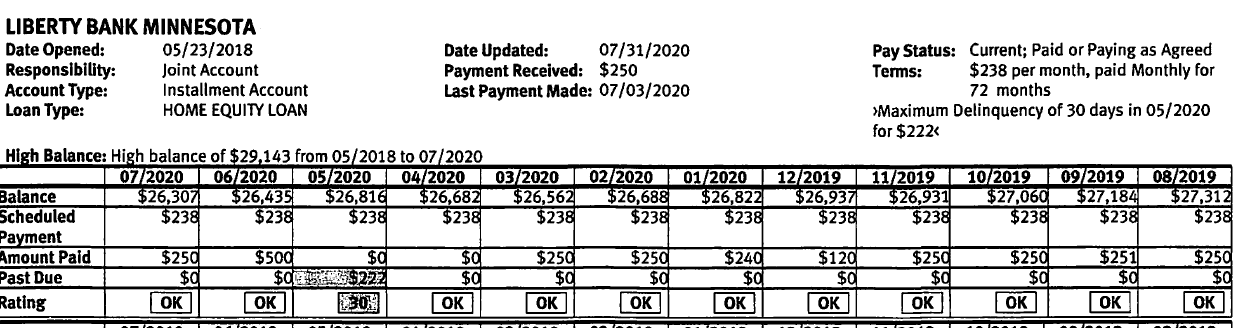

- What about car loans and mortgages? Loans with collateral like car loans and mortgages only appear on the credit report if borrower signed a reaffirmation agreement during the bankruptcy and the lender then filed it with the court. If there was not a reaffirmation agreement, then the borrower can continue to make payments on the loan and keep the collateral, but that payment history won’t appear on the credit report. Reaffirmation is confusing! To learn more about it, read this article. If the car loan or mortgage is not reaffirmed, then the credit report should look like this, EVEN IF the borrower still is paying or paid it off.

- If the car loan or mortgage is reaffirmed, then it should resume the payments every month, except the status explained should say “reaffirmed.” Lenders often forget to updated credit reporting and tell the credit bureaus that payments are getting made on a reaffirmed loan. If you reaffirmed and the payments aren’t showing up on your credit reports, then you should talk with a lawyer about disputing!

Does all of this seem complicated? Walker & Walker does free credit report reviews and disputing for all of our bankruptcy clients. We double check after filing to make sure that the report is showing exactly what it should so that you can build credit quickly. Sometimes we even win settlements for our clients when the credit bureaus refuse to fix their mistakes.