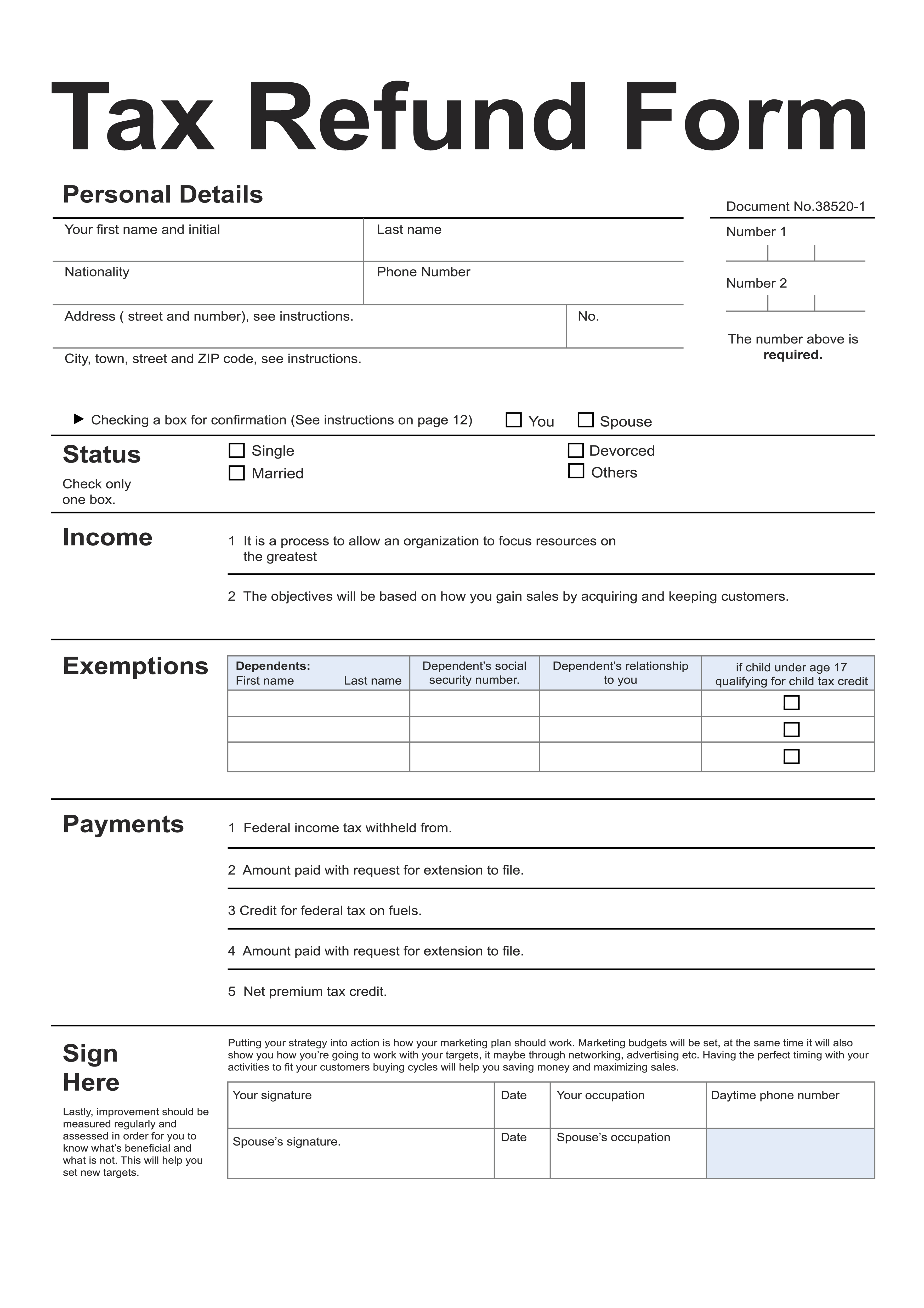

Illustration of tax refund form

Tax return filing season is starting soon. The IRS will let people file a little earlier than usual on January 24th. What about the state of Minnesota? At present, the Minnesota Department of Revenue has not announced what day they will start accepting tax returns, but it’s likely the same day because most people efile the returns at the same time.

Why does a bankruptcy lawyer care about tax return filing? Because lots of people who need to file bankruptcy live paycheck to paycheck and depend upon their tax refunds to make ends meet every year. Walker and Walker is careful to work with people to protect as much of their refund as possible.

WHEN IS A TAX REFUND NOT PROTECED IN BANKRUPTCY?

In Minnesota, tax refunds are protected up to a certain dollar amount unless you own a house. If you own a house, then the laws are set up so that to protect the house, you must protect less property of other sorts.

If you own a house, then any tax refunds that the government owes to you on the day that the case is filed are not protected, EXCEPT the Earned Income Credit and Minnesota Working Family Credit. These two credits are very important for people with children, so the law protects them. Want to read the court opinion which says why those are protected? It’s right here: In re Tomczyk (2003) by Judge Kressel.

Chapter 7 Bankruptcy only counts tax refunds that the government (either MN or the federal government) owed to you on the day your case was filed. They don’t follow you for taxes every year after filing.

SHOULD I FILE MY TAX RETURN EARLY? WHAT IMPACT WILL THAT HAVE ON MY BANKRUPTCY?

Filing early is almost always best for your bankruptcy. If you have a house and some of your refund won’t be protected, then if you get the refund and spend it (or save it in an IRA) before the filing day, you won’t lose the refund. You would never have to pay extra into the bankruptcy because a tax return got filed early.

WHAT ELSE SHOULD I THINK ABOUT WITH TAX REFUNDS AND BANKRUPTCY?

Often it is necessary to switch bank accounts when you are filing bankruptcy. Make sure to doublecheck the direct deposit account on your tax return so that it goes into a bank account that you are still using! It can be very hard to recover a tax refund that went into a closed bank account. Sometimes the bank that received the refund keeps it to pay a debt that we discharged in bankruptcy.

The IRS will let people file a little earlier than usual on January 24th.

IS THERE ANYTHING I SHOULDN’T DO WITH THE TAX REFUND?

If you have debt or are thinking about bankruptcy, then don’t do any of the following things:

- Use the money to pay back friends or family members. If you pay them back AFTER filing, then it’s ok.

- Put the refund into someone else’s account. This is sometimes a fraudulent transfer. You should always try to keep control of you money anyhow.

- Use it to buy a car or house in someone else’s name. Buying expensive items in other peoples’ names generally causes trouble in Minnesota.

Thinking about filing bankruptcy? We have a free attorney consultation to find out if bankruptcy would be a good idea for you or not. Just call us at 612-824-4357 or book an appointment online at www.calendly.com/wwattorneys.