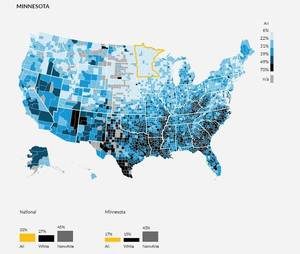

A study and heat map prepared by the Annie E. Casey Foundation and hosted by the Urban Institute show that Minnesotans have less debt in collections than people in other states.

Only 17% of Minnesotans have debt in collections, but 33% of Americans have debt in collections.

Thus people in the rest of the country are essentially TWICE as likely to have debt in collections as people in Minnesota.

Map showing people with debt in collection across the USA (Click for larger image – opens in new tab)

Interestingly, the highest rate of debts in collection are predominantly in the South Eastern states.

What is a debt in collection?

A debt in collections means that the person didn’t pay the a bill to a company, so the company sold the bill to a debt collection company.

This debt could be anything from a credit card to a repossessed car, or even something smaller like an unpaid bill for Internet service, a cell phone, or electricity.

Most companies do not want to spend lots of time calling their customers and bothering them to pay a debt, so they sell it to a collection company if it is not paid after a few months.

Selling a debt to a collection company is also called a charge off. Collection companies write letters and call people to convince them to pay the debt.

What happens next?

If that doesn’t work, then the collection company may hire a debt collection law firm to file a lawsuit to sue the consumer and get a judgment.

The judgment can then be used to garnish wages or freeze bank accounts.

What else does the map tell us?

An interesting thing about the map is that it analyzes the data based on peoples’ race.

Nonwhite people in Minnesota have debt in collections at a much higher rate than Minnesotans overall and also much higher than white people.

According to the data:

- 17% of Minnesotans have debt in collections

- 15% of white Minnesotans have debt in collections

- 43% of nonwhite people have debt in collections

Nationwide:

- 27% of white people have debt in collections

- 45% of nonwhite people have debt in collections

Why do fewer Minnesotans have debt in collections compared to other states?

So, why do fewer Minnesotans have debt in collections compared to people from other states?

As an experienced Minnesota bankruptcy lawyer, I honestly do not know.

I have never practiced bankruptcy law in any other states so I don’t have a basis for comparison.

One thing I do know about the Minnesotans who see me to get help with debt is that they are honest people.

They are usually talking with a bankruptcy lawyer because they need to financially recover from some bad event that happened to them.

Typical bankruptcy clients cite things like:

- Divorce

- Loss of a job

- Loss of their health

- Starting a business that didn’t work out

The people who come to my offices in Minneapolis, St Paul, Blaine or Brooklyn Park have usually made every effort to pay their debts, and they are not looking for a handout.

They are usually embarrassed that some of their bills have gone to collections.

Maybe people in other states are different?

What to do next

If you’re struggling financially in Minnesota and have debts in collection, or want to avoid having debts in collection why not not speak to us now at 612.824.4357?

Alternatively, fill out our free Bankruptcy Evaluation Form to see if filing for Chapter 7 Bankruptcy or Chapter 13 Bankruptcy in Minnesota is right for you.

We’re looking forward to helping you.