If a business isn’t making money and isn’t likely to start making money soon, then it often makes sense to close it. In modern America, there are many expensive costs to running a business, even one that isn’t making money, so it can make sense to close it quickly before the losses get larger.

If a business isn’t making money and isn’t likely to start making money soon, then it often makes sense to close it. In modern America, there are many expensive costs to running a business, even one that isn’t making money, so it can make sense to close it quickly before the losses get larger.

But how do you actually close a business? There are 3 basic ways to close a business in Minnesota. Which one is best really depends on the size of the business and what sorts of assets and liabilities it has, and what the owner or owners wants to do for their career going forward.

3 WAYS TO CLOSE A BUSINESS IN MINNESOTA

METHOD NUMBER 1: SIMPLY WALK AWAY.

The owner an simply leave one day, stop answering phone calls, emails, letters, and other messages. Stop helping customers, stop paying employees, rent, suppliers and vendors, taxes and the landlord. This method will leave others to pick up any pieces and will probably mean that employees, suppliers, vendors, the landlord and customers will be angry and the business will owe money to those people and companies. The owner may even get sued for this, but it is a common way that businesses close.

Can those business creditors (customers, employees, vendors, suppliers, landlords, and lenders) collect from the owners of the business? Maybe. That depends on whether there is a business entity like a corporation or an LLC or not, and whether the owner has personally guaranteed any of the debts. Personal guarantee means that the owner owes whatever liability he or she guaranteed. The personal guarantee is a paragraph in the contract. It is usually boiler plate for all loans, leases, and vendor agreements. Customer refunds and unpaid wages are usually not personally guaranteed because the business owner controls the contract for these things. Other debts are usually personally guaranteed.

What if there is no LLC or Corporation? If there is no business entity, then the business counts as a sole proprietorship. The proprietor is the owner and he or she automatically owes all of the debts of the business. This includes customer refunds, leases, loans, payroll and everything else. This can be a lot of money, and it is probably best to file a personal chapter 7 or personal chapter 13 bankruptcy to discharge this debt and get on with life.

Technically, Minnesotans are not supposed to take this route. They are supposed to pay all liabilities, terminate the LLC or Corporation and file a final tax return to avoid any liability for it afterwards. However, being in a money-losing business is stressful, and the business owner usually has to use his time to work on something else to make money to afford food and shelter, so it is not uncommon for a business to be simply abandoned.

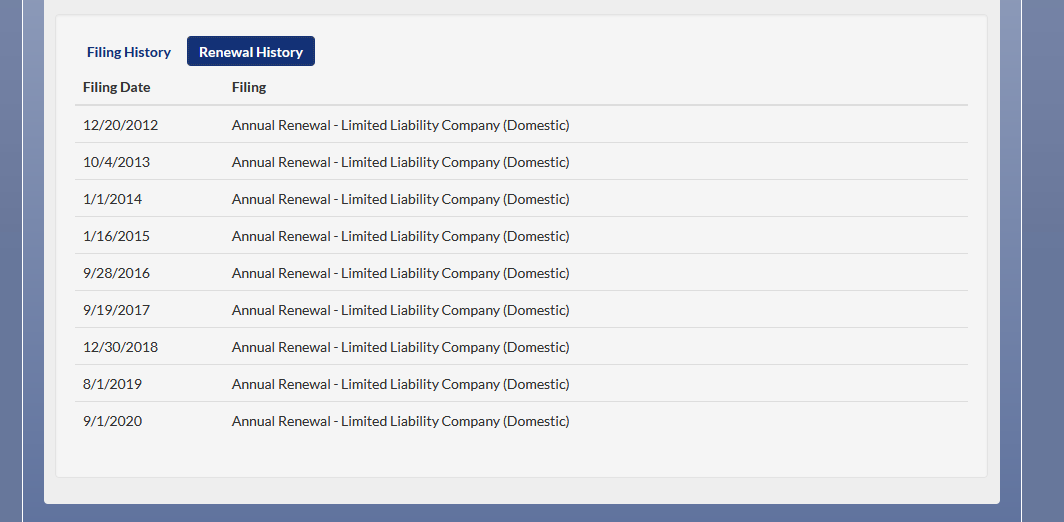

If there is an LLC or Corporation, then normally the owner or an employee renews the LLC or corporation with the secretary of state every year. Because no one is doing things to take care of the business anymore, the business won’t get renewed. This means that there is no more limited liability, so the owners owe all of the debts of the business. They may also owe additional taxes, so it is best to avoid this route.

The business below has been renewing every year. If you do nothing, then the company dissolves automatically.

METHOD NUMBER 2: WIND DOWN THE COMPANY

This is the way that the legal system and business school textbooks talk about. When you wind down a business, The company must first send to each shareholder a letter saying that it intends to dissolve. Here is the form. Then the business stops taking on new work or customers, finishes the work for all of its existing customers, and then sells everything it owns and puts the sale proceeds into a bank account. This includes selling things like office furniture, and collecting on old debts that customers owe to the company.

You should make sure to read the operating agreement and bylaws and any member control agreement or shareholder control agreement. These can include special items that the company must do as part of winding down.

The company then pays out the money in this bank account first to all liabilities and then to the owners or shareholders if there is anything left. These payments don’t pay off all of the debts, then the creditors will try to use the personal guarantees to collect from the owners. The company should file a final tax return with the IRs and the Minnesota Department of Revenue.

After this, then the owner will go to the Minnesota Secretary of State business website and file the statement of termination.

METHOD 3: FILE BANKRUPTCY

When a business files chapter 7 bankruptcy in Minnesota, the LLC or Corporation ceases to exist and all of its assets, if any, are sold to pay liabilities such as payroll, taxes, customers, landlords, lenders, suppliers, and vendors. The bankruptcy code has a special system of priorities for what type of debt gets paid first.

This route is less expensive than route 2, but still costs attorney’s fees, and it is also better organized than route 1. One of the better things about it is that the assets of the business often go to pay the taxes, which the business owners owe personally after the company shuts down.

Why isn’t chapter 11 bankruptcy on this list? Because a business does not shut down in chapter 11 bankruptcy. With a chapter 11, the company can renegotiate leases and lower the balance on long-term loans and discharge completely many debts to vendors and suppliers.

Not sure what is right for you? Walker & Walker offers a free consultation with an attorney at 612-824-4357 to learn your options. We help with chapter 7, 11, and 13 bankruptcies for people and for businesses. I know there is nothing more stressful than a business that is losing money, so why not call an attorney today and see what can be done! The conference is free.