Facing Bankruptcy? Give Walker & Walker a Call Today!

Bankruptcy provides relief to individuals and families every year in Minnesota. Despite being an option for many, some of the people who need debt relief the most are unable to file or must jump through hurdles due to prohibitive federal laws.

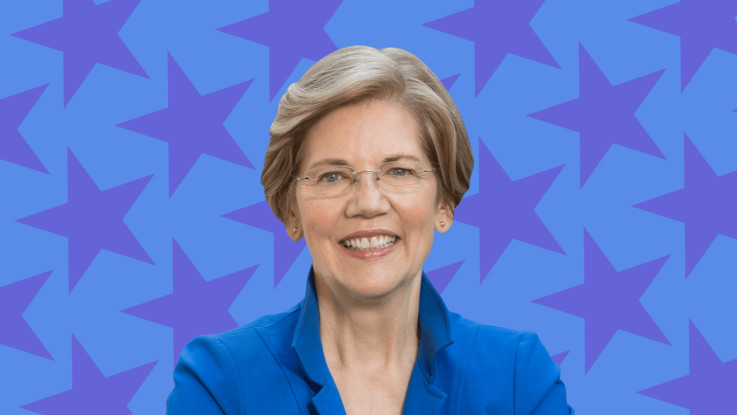

The Bankruptcy Reform Plan proposed by Elizabeth Warren would eliminate many of the barriers that hard working people face when filing for bankruptcy. To fully understand why bankruptcy reform is needed, we must first take a look at the reasons people file for bankruptcy.

Top Reasons for Filing Bankruptcy

Unfortunately, there are still many myths surrounding bankruptcy. It’s a common misconception that anyone filing for bankruptcy has lived beyond their means or incurred debts with no intentions of paying them off. Nothing could be farther from the truth.

In doing research, Warren found that 90% of individual bankruptcies were filed for three reasons:

- Job loss

- Medical problems

- Divorce or family breakup

In 2005, the Bankruptcy Abuse Prevention and Consumer Protection Act was passed. In reality, this act did little to “protect consumers.” It created a complex, broken bankruptcy system that puts debt relief outside the reach of too many Americans.

How the Bankruptcy System is Broken

After bankruptcy laws changed in 2005, bankruptcy filings did indeed go down. But according to the Bankruptcy Reform Plan, it wasn’t because Americans were doing well financially. The flipside of decreased bankruptcy filings was an increase in:

- The number of insolvent people

- Credit card debt costs

- Mortgage defaults

- Foreclosures

With no opportunities for debt relief, many families lost everything.

What Meaningful Reform Looks Like

A Streamlined Bankruptcy Process

Currently, there are two options for individuals who want to file bankruptcy. Households that pass a means test can file for chapter 7 bankruptcy, which is often referred to as a “straight bankruptcy.” Families that make above a certain amount are unable to file chapter 7, and their only option is chapter 13 bankruptcy.

A chapter 13 bankruptcy requires individuals to set up a payment plan with their creditors. These payment plans only extend the bankruptcy process. According to Warren’s Reform Plan, many families never actually have their debts discharged. They cannot keep up with the payment plan over the long term.

The proposed Bankruptcy Reform Act streamlines the process and eliminates the need for two types of individual bankruptcy. Filers would be able to choose certain debts they want to keep and make payments on, for example, their home or a vehicle they need to get to work.

Eliminating Barriers to Filing

Another hurdle that individuals encounter is mandatory pre-filing credit counseling, sometimes called “debt education.” This is an additional time and financial burden on people already feeling strapped. Families know their financial situations best and have already spent countless hours crunching numbers. Often, there is little value in having a third party create a budget plan.

All Consumer Debts Would be Treated Equal

As the bankruptcy laws currently sit, some debts cannot be discharged, like student loans and local government fines. The Reform Act would treat these debts like other consumer debts, allowing them to be discharged in bankruptcy.

Experienced Twin Cities Bankruptcy Attorneys Fighting For You

We know bankruptcy reform cannot come soon enough for some Minnesotans. However, under the current laws, debt relief is still possible for many people.

Are you and your family facing mounting debt? Are you struggling to pay your rent or mortgage because you’re juggling other loans and credit card debts? Give the experienced bankruptcy attorneys at Walker & Walker a call.

During a free consultation, we’ll go over your situation. After meeting with us, you are under no obligation to pursue bankruptcy. We will help you understand what your options are. Please contact us today.

Source: