The short answer is no. Filing bankruptcy DOES NOT affect a cosigner’s credit. A bankruptcy only goes onto the credit report of the person who filed the bankruptcy. The tradeline for the cosigner, sometimes called a codebtor, will also not say bankruptcy. If the payments on the loan stop, however, then the nonpayment of the loan will be on the cosigner’s credit report.

WHAT IS A COSIGNER?

A cosigner or codebtor is someone who agrees to pay a debt in the event that the primary borrower does not pay that debt. The cosigner owes 100% of the balance the whole time. This is true even when the primary borrower is making the debt payments normally.

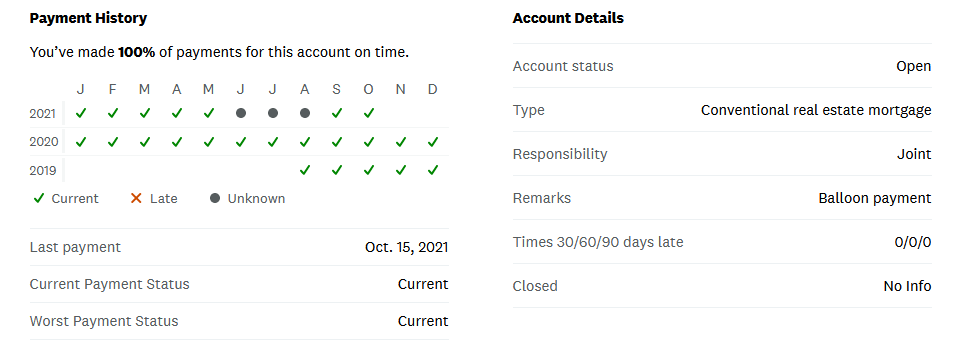

The balance and payment history will show up on the cosigner’s credit report just the same way as they do on the primary borrower’s credit report. There is a place on each trade line on a credit report where it says if there are any cosigners for debts. If there is a cosigner, then the report will say “Responsibility: Joint.” If there is no cosigner, it will say “Responsibility: Individual.” When there is a cosigner, the report will look like the picture below.

WHAT SHOULD THE COSIGNER’S CREDIT REPORT SHOW AFTER BANKRUPTCY?

The cosigner’s credit report will continue to show whatever happens to the payments of the loan. If the payments continue (either by the cosigner or by the person who filed bankruptcy), then the payment history will continue to show paid and current. BUT if the payments on the loan stop, then it will show “no payment” or eventually collections.

That’s right, the bankruptcy itself isn’t bad for the cosigner’s credit report, but if the loan payments stop after the bankruptcy, then it will harm the cosigner’s credit report for nonpayment.

Every so often, a lender will just stop reporting anything new on a loan after one borrower has filed bankruptcy. The information on credit reports comes from loan companies voluntarily telling the credit bureaus whether or not the lender received a payment every month. They are not obligated to tell credit bureaus anything if they want to be silent about it. A few loan companies stop reporting the payments to the credit bureaus for both borrowers if only one files bankruptcy. If this happens, then the loan will still show the last payment before bankruptcy and be listed as an account in good standing.

Walker and Walker helps clients improve their credit score in the time after bankruptcy. We will pull your credit reports for free and dispute any inaccuracies post-filing. A fresh start is important.

If you live in Minnesota and would like to have a free consultation to learn if bankruptcy is right for you, then call us at (612) 824-4357, or click here to arrange a free attorney consultation online.