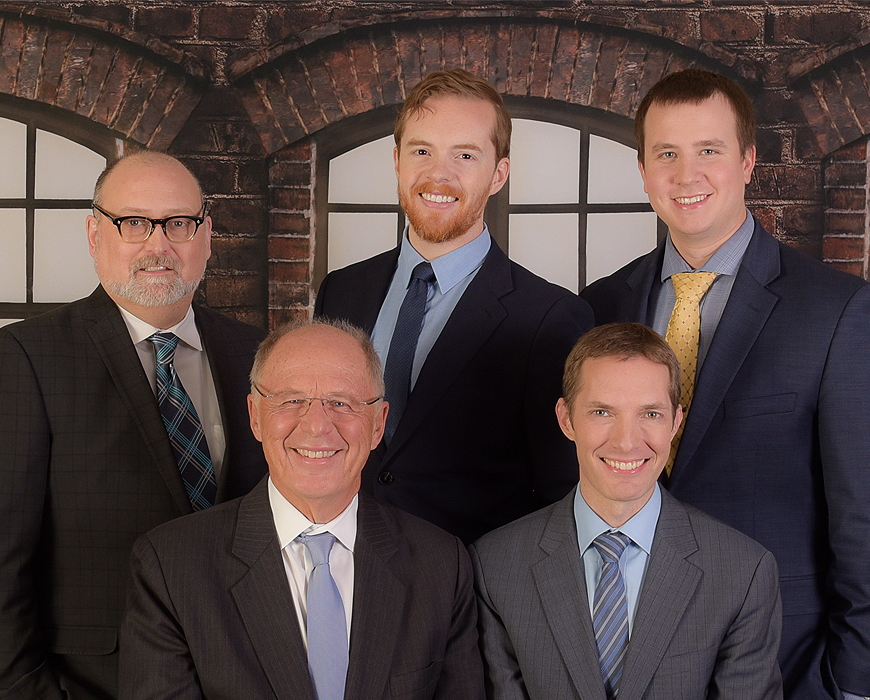

We are a Family business in 4 locations in Minnesota, with over 40 years experience helping Minnesotans get out of debt and build credit.

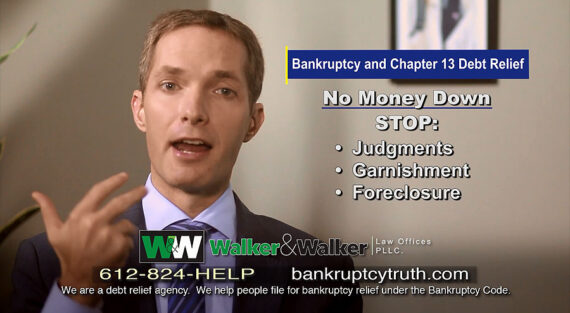

We don’t just do the paperwork to file Chapter 7 Bankruptcy and Chapter 13 Bankruptcy, we also help you to improve your credit rating after bankruptcy, and win settlements for clients who have been targeted with illegal debt collection or credit reporting.

You can find us in Blaine, Brooklyn Park, Minneapolis and St. Paul.

What will we do for you?